Our goal at InstaEMI, a Loan Company happy to provide access to personal loans and education loan, car loan, home loan at competitive interest rates.

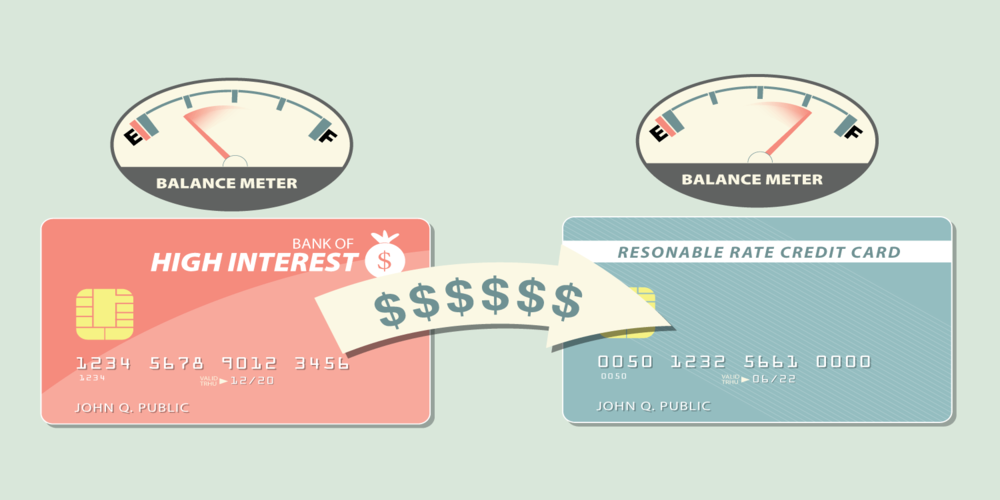

A personal loan balance transfer is a process by which an individual can transfer the outstanding balance of their personal loan from one lender to another. This is typically done to take advantage of a lower interest rate or more favorable terms offered by the new lender.

The process of transferring a personal loan balance typically involves paying off the outstanding balance of the loan with the original lender using the proceeds from a new loan from the new lender. The individual then makes payments on the new loan to the new lender.

In order to qualify for a personal loan balance transfer, an individual typically needs to have a good credit score and a stable income. Additionally, some lenders may require that the individual has a certain amount of equity in their home or other assets.

It is important to note that there may be fees associated with a personal loan balance transfer, such as balance transfer fees or early repayment fees. It is important to compare these costs with the potential savings from the lower interest rate before proceeding with a balance transfer.