Our goal at InstaEMI, a Loan Company happy to provide access to personal loans and education loan, car loan, home loan at competitive interest rates.

A credit score is a numerical value that represents an individual’s creditworthiness. It is used by lenders and financial institutions to determine the risk of lending money or extending credit to a borrower. The most widely used credit score is the FICO score, which ranges from 300 to 850.

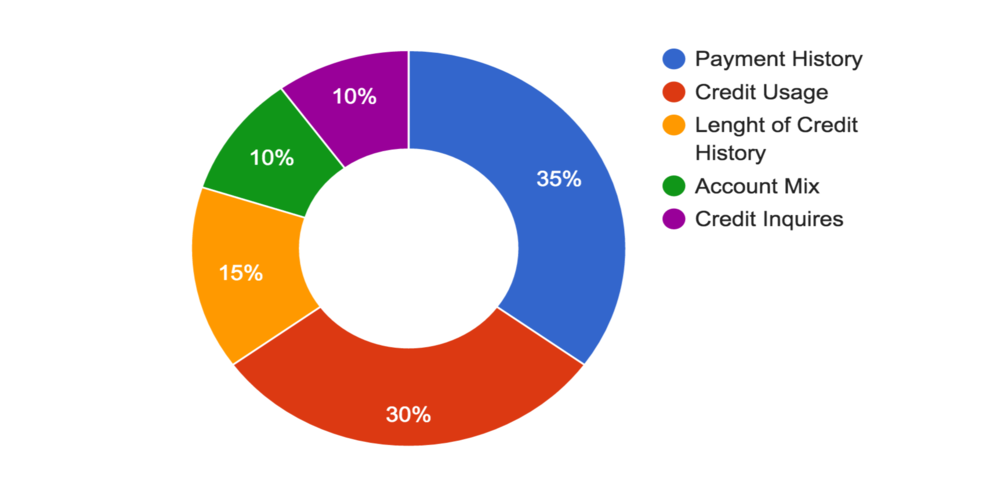

There are several components that make up a credit score, including:

Payment history: This accounts for 35% of your credit score and measures whether you have made your payments on time. Late payments can have a negative impact on your credit score.

Credit utilization: This accounts for 30% of your credit score and measures how much of your available credit you are using. It is recommended to keep your credit utilization below 30%.

Length of credit history: This accounts for 15% of your credit score and measures how long you have had credit. A longer credit history can positively impact your score.

Types of credit: This accounts for 10% of your credit score and measures the variety of credit accounts you have, such as credit cards, loans, and mortgages.

New credit: This accounts for 10% of your credit score and measures how many new credit accounts you have opened recently.

To improve your credit score, you should:

Make payments on time: Late payments can have a negative impact on your credit score.

Keep your credit utilization low: Try to keep your credit utilization below 30%.

Maintain a long credit history: Try to keep your credit accounts open for as long as possible.

Diversify your credit: having a mix of credit accounts can be beneficial

Be mindful when opening new credit: don’t open too many new credit accounts at once, as it can be seen as a red flag.

It’s important to note that building a good credit score takes time, so be patient and consistent with your efforts.