Our goal at InstaEMI, a Loan Company happy to provide access to personal loans and education loan, car loan, home loan at competitive interest rates.

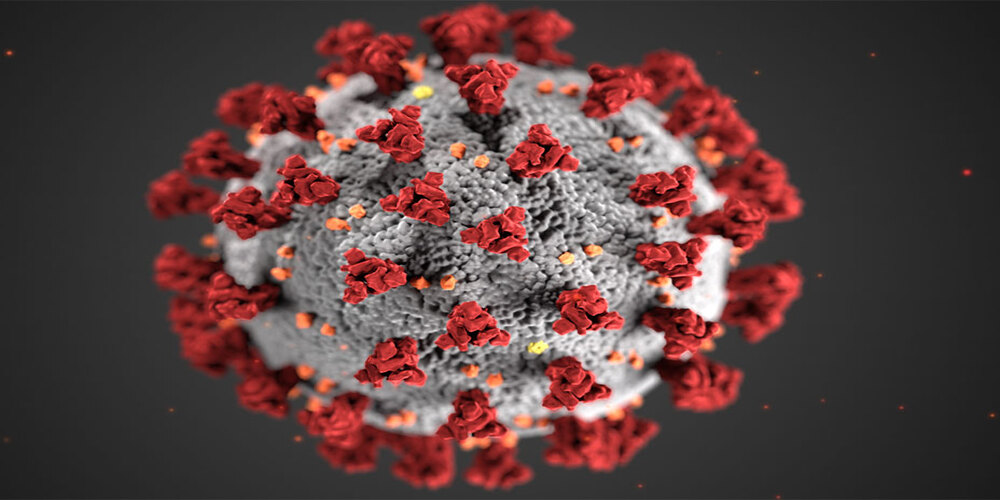

The COVID-19 pandemic has had a significant impact on the home loan market, affecting both borrowers and lenders. Some of the key ways that the pandemic has impacted the market include:

Low interest rates: RBI has lowered interest rates to near-zero in response to the pandemic, which has led to lower mortgage rates for borrowers. This has made it more affordable for people to buy homes and has also led to an increase in refinancing activity.

Economic uncertainty: The pandemic has caused economic uncertainty and job loss for many people, which has made it more difficult for some borrowers to qualify for a home loan. Lenders have become more cautious, and some have tightened their lending standards.

Delays in the loan process: The pandemic has caused delays in the loan process, as lenders and title companies have had to adjust to remote work and social distancing measures. This has led to longer wait times for borrowers to close on a loan.

Get pre-approved: Before you start looking for a home, get pre-approved for a mortgage loan. This will give you an idea of how much you can afford and will also make you a more attractive buyer to sellers.

Shop around: Compare rates and fees from multiple lenders to find the best deal.

Be prepared for delays: Be prepared for delays in the loan process, and be patient as lenders and title companies work through the challenges caused by the pandemic.

Keep your credit score high: Having a good credit score will make it more likely that you’ll qualify for a loan and will give you a better chance of getting a lower interest rate.

Stay informed: Stay informed about the latest developments in the home loan market, including changes to lending standards and loan products.

It is important to keep in mind that the situation is constantly changing, so it’s important to stay informed and to be flexible as you navigate the home loan market during the pandemic.