Our goal at InstaEMI, a Loan Company happy to provide access to personal loans and education loan, car loan, home loan at competitive interest rates.

Mortgage fees and closing costs are the additional expenses that come with obtaining a mortgage loan. Understanding and comparing these costs is important because they can add thousands of dollars to the total cost of your mortgage.

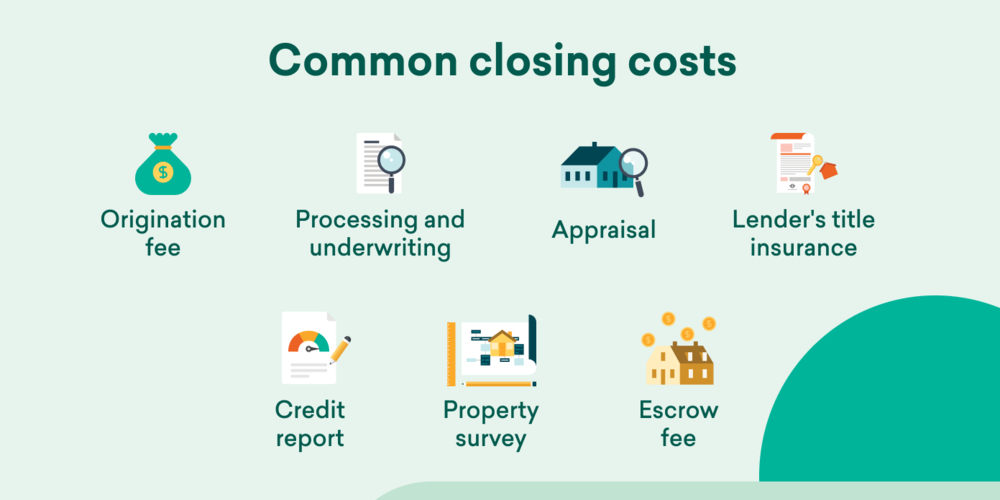

Here are some common mortgage fees and closing costs to be aware of when comparing loans:

Application fee: A fee charged by the lender to process your mortgage application.

Origination fee: A fee charged by the lender for originating the loan, usually a percentage of the loan amount.

Points: A fee that can be paid upfront at closing to lower the interest rate on the loan. One point is equal to 1% of the loan amount.

Appraisal fee: A fee to have the property appraised to determine its value.

Credit report fee: A fee to obtain the borrower’s credit report.

Title search and insurance: A fee to search for any liens or judgments on the property and to obtain title insurance.

Survey fee: A fee to survey the property.

Escrow fee: A fee for setting up and maintaining an escrow account to pay taxes and insurance.

Recording fee: A fee to record the mortgage with the local government.

Underwriting fee: A fee charged by the lender for underwriting the loan.

It’s important to ask each lender for a breakdown of all the fees and costs associated with the loan and compare them between lenders. You can also ask for a “good faith estimate” or “loan estimate” which is a document that provides an estimate of the fees and costs associated with the loan. It’s also a good idea to compare the APR (Annual Percentage Rate) instead of just the interest rate, as APR takes into account the fees and costs associated with the loan.

By understanding and comparing mortgage fees and closing costs, you can make an informed decision and find a loan that fits your needs and budget.