Our goal at InstaEMI, a Loan Company happy to provide access to personal loans and education loan, car loan, home loan at competitive interest rates.

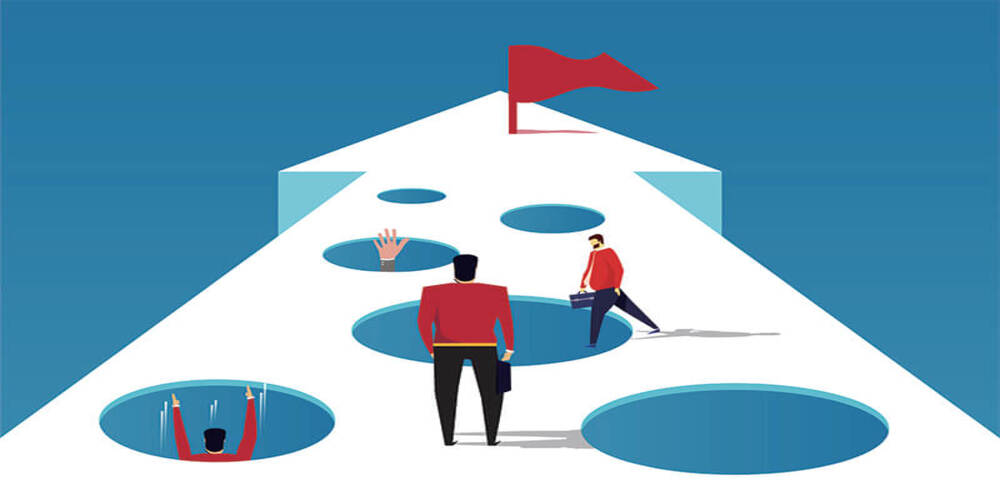

There are a few potential pitfalls to be aware of when using a credit card balance transfer, including:

Balance transfer fees: Some credit card companies charge a fee for balance transfers, which can be a percentage of the amount transferred or a flat fee. Be sure to factor these fees into your decision and compare them to the savings you will receive from the lower interest rate.

Introductory rate expiration: Many credit card companies offer an introductory rate for balance transfers that is lower than the regular rate. Be sure to find out how long the introductory rate will last and what the regular rate will be afterwards. If you don’t pay off the balance before the introductory rate expires, you may end up paying more in interest than you would have with your original card.

New purchases: Avoid using the card for new purchases while you’re trying to pay off your debt. New purchases will increase your balance and make it harder to pay off your debt.

Paying only the minimum: Make sure to pay more than the minimum each month as paying only the minimum each month will prolong the time it takes to pay off your debt and increase the amount of interest you pay.

Not closing the old accounts: After transferring the balance, it’s important to close the old accounts, so you’re not tempted to use them and end up with additional debt.

Not changing the spending habits: A balance transfer can help you lower your interest rate and make your payments more manageable, but it’s not a long-term solution if you don’t change your spending habits, if you don’t address the root of the problem of accumulating debt, you’ll end up in the same situation again.

By being aware of these potential pitfalls and taking steps to avoid them, you can make the most of a credit card balance transfer and work towards paying off your debt faster.